ON THIS PAGE

- Workers’ Compensation Insurance: Who Needs It and What Does It Cover?

- What makes Workers’ Compensation Insurance so unique?

- What does Workers’ Compensation Insurance cover?

- Work and risk classification codes

- What are the penalties for going without state-mandated Workers’ Compensation Insurance?

- For comparison, the State of Alaska requires:

- While the State of Florida requirements are:

- Workplace Hazards, Risks, and Dangers

- Safety Hazards

- Physical Hazards

- Biological Hazards

- Chemical Hazards

- Ergonomic Hazards

- Workplace Organizational Hazards

- What’s changing in the Workers’ Compensation Insurance realm?

What is the Cost of Having Workers' Comp Insurance? Cost of Not Having It?

Employers purchase Workers’ Compensation Insurance to cover the costs of injuries and medical provisions for employees hurt on the job. When this insurance is purchased, employers cannot be held liable for employee injuries in most states, except in narrow circumstances. However, if employees are injured at work in ways not covered in the Workers’ Compensation Insurance policy, injured employees may attempt to still seek damages in a lawsuit. That’s what makes it so essential for employers to fully understand the laws on Workers’ Compensation Insurance.

What makes Workers’ Compensation Insurance so unique?

Workers’ Compensation Insurance is unique in that it’s regulated by the states. Every state in the country but Texas requires businesses with employees to carry Workers’ Compensation Insurance, and some states even require it for businesses without employees. Depending upon the type of work the business provides, in which state/s they do business, and how many employees they have, the costs of Workers’ Compensation Insurance can vary significantly.

The other problem with interest-only loans is that at some point you have to either refinance your way out or pay it off

What does Workers’ Compensation Insurance cover?

Most Workers’ Compensation Insurance policies cover expenses associated with an employee’s illness or injury suffered or caused while working. This can include:

- Wage replacement

- Medical bills

- Any necessary ongoing or additional care such as vocational rehabilitation

- Legal expenses if the employee sues for incidents not covered by your existing policy

Work and risk classification codes

The work each business does is categorized into ‘codes’ by the National Council on Compensation Insurance, or the NCCI. The NCCI oversees Workers’ Compensation issues throughout the country. The codes, which number to over 700, each correspond to a certain type of work and the risks associated with performing that type of work according to research. The greater the risk of injury associated with the type of work, the higher the costs of Workers’ Compensation Insurance..

To give an example on the range of costs for Workers’ Compensation Insurance, here is a chart from the Bureau of Labor Statistics (March 2021) information categorizing work types and costs divided into the various types of compensation.

How are Premiums Calculated for Workers' Comp?

The formula that is used to calculate the insurance premium for workers' compensation is: Class Code Rate x ( Payroll / $100 ) x Experience Modifier = Premium Rate

What are the penalties for going without state-mandated Workers’ Compensation Insurance?

Just like the states determine the parameters and costs of their own Workers’ Compensation Insurance, the states also decide what their penalties will be for noncompliance. Most states prefer to charge a fine in cases of noncompliance, with the size of the fine varying with the number of days spent noncompliant as well as the size of the company/number of employees. Intentionally providing misleading information regarding your company’s employees or their type of work might be considered intentional noncompliance, which carries a heftier fine. Some states even consider intentional noncompliance a felony as well.

In some states, jail time may even be a possibility for noncompliance. Illinois, Massachusetts, Pennsylvania, Michigan, and California all carry some type of criminal penalty greater than a monetary fine for Workers’ Compensation Insurance noncompliance.

For comparison, the State of Alaska requires:

- Employers with one or more employees must obtain Workers’ Compensation Insurance in Alaska (unless the employer is approved as self-insured)

- Exceptions include: sole proprietors, general partners in a partnership, executive officers of nonprofits corporations, part-time babysitters, members in a member managed limited liability company, non-commercial cleaning persons, sports officials for amateur events, commercial fishers, and a few others. Please consult the state website for further details.

- Substantial civil and criminal penalties may apply to any employer who fails to maintain the appropriate Workers’ Compensation Insurance

- The price of the policy premium in Alaska is based upon the employer’s payroll, classification assignment, or type of business risk, and the employer’s loss history

- Alaska’s Assigned Risk Pool, as administered by the National Council on Compensation Insurance, or (NCCI), can provide insurance if an employer is unable to purchase coverage from commercial insurance carriers

- If an employer believes their premium is either too high or their business has been improperly classified, they may contact the NCCI and the Alaska Review and Advisory Committee for further action

While the State of Florida requirements are:

- Florida Workers’ Compensation Insurance requirements vary based on the type of industry, number of employees, and entity organization

- In the construction industry, a company with 1 or more employees is required to have Workers’ Compensation Insurance (including the owner as a corporate officer or Limited Liability Company member)

- In a non-construction industry, a company with 4 more employees is required to have Workers’ Compensation Insurance, with same inclusions as noted above

- In the agricultural industry, a company with 6 more employees (or 12 seasonal workers working more than 30 days in a season but not more than 45 in year) is required to have Workers’ Compensation Insurance

- For out of state employers, insurance carriers must be notified they are working in Florida and obtain Compensation Insurance with a Florida-approved carrier (for details on Extraterritorial Reciprocity rules, consult the website directly)

- Contractors are required to ensure sub-contractors have Compensation Insurance before beginning work, per the 69L-6.032 Florida Administrative Code. Without such insurance, the sub-contractors automatically become the employees of the contractor, and the contractor is then responsible for all work-related injury, illness, or fatality expenses which may occur.

- Exemptions exist for those qualify, but certain requirements must be met. Please consult website directly for details.

Workplace Hazards, Risks, and Dangers

Depending upon your type of work, various dangers and risks of injury may exist at your workplace. Becoming aware of these and obtaining the proper training on how to handle them are essential to a safe, productive, and injury-free workplace. (If these types of risks exist at your workplace and you haven’t received this type of training yet, contact your employer immediately.)

Safety Hazards

These include anything that can spill, cause someone to trip, cause someone to fall, unguarded machinery, electrical wiring that has become frayed or is otherwise hazardous, and confined spaces.

Physical Hazards

These include anything that can harm the body without necessarily coming into contact with it. Heavy sunlight exposure/ultraviolet rays, persistent loud noises, extreme temperatures, and radiation of either ionizing or non-ionizing types are all considered physical hazards.

Biological Hazards

These include areas or items which expose workers to harm or disease. Often, these are associated with animal care-taking activities, working directly with people, or infectious plant materials. Types of exposures include:

- Blood and other types of bodily fluid

- Bacteria or viruses

- Plants

- Droppings of animals and/or birds

- Fungi-mold insect bites

Chemical Hazards

These are areas or items of solid, gas, or liquid form which can cause skin irritation, illness, breathing problems, or other types of injuries if a worker is exposed to them. Examples include:

- Vapors and/or fumes from solvents or welding activity/materials

- Gases like propane, helium, acetylene, or carbon monoxide

- Chemicals like paints, acids, solvents, cleaning products, etc., especially if these substances are not in a properly labeled container

- Gasoline, solvents, and other types of flammable and/or explosive chemicals pesticides

Ergonomic Hazards

These include office equipment that can cause injury with or without prolonged use. Examples include:

- Improperly adjusted chairs, desks, computer equipment, or other types of work stations

- Poorly maintained posture while using office equipment

- Frequently or improper lifting

- Actions that require the use of force, especially if repeatedly or frequently required vibration

- Awkward movements, especially if repeated frequently

Workplace Organizational Hazards

These include any types of hazards that create either short term or long term stress for the worker exposed. These hazards include:

- Workplace violence

- An intense type or pace of work

- Intense workplace demands or a heavy workload

- Lack of flexibility

- Lack of respectful treatment

- Lack of control

- Lack of say in how work is done

- Lack of social support

- Sexual harassment

Based on these fluctuations, it’s difficult to predict an exact amount for Workers’ Compensation Insurance across the board. Here are some specific situations to consider if you need to obtain Workers’ Compensation Insurance for your company:

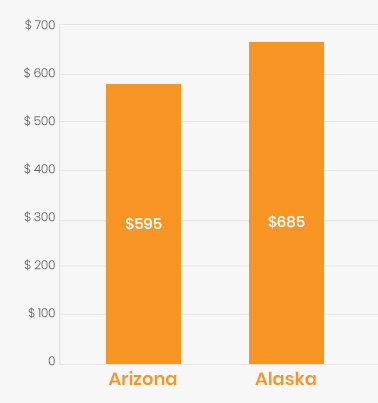

For a locksmith located in Arizona with 9 or fewer employees, paying out less than $24,999 in payroll annually, with 4 or more years of experience and less than 10 percent of work contracted out, Workers’ Compensation Insurance was quoted at approximately $595 per year. For an employer with approximately the same criteria in Alaska, a quote of $685 was given.

What’s changing in the Workers’ Compensation Insurance realm?

Individual states, as previously mentioned, oversee most Workers’ Compensation Insurance rules and regulations. Therefore, changes often happen in pieces by region. However, in the last few decades, the overall opinion on Workers’ Compensation Insurance is that it is insufficient to cover workers for most injuries, especially if they are serious. A trend for small business owners may be developing in this regard, which means that:

- The prices on Workers’ Compensation Insurance policies are quite low – the lowest they have gone in almost three decades

- Employers may be at growing risk of being sued in lawsuits filed over employee injuries in some states